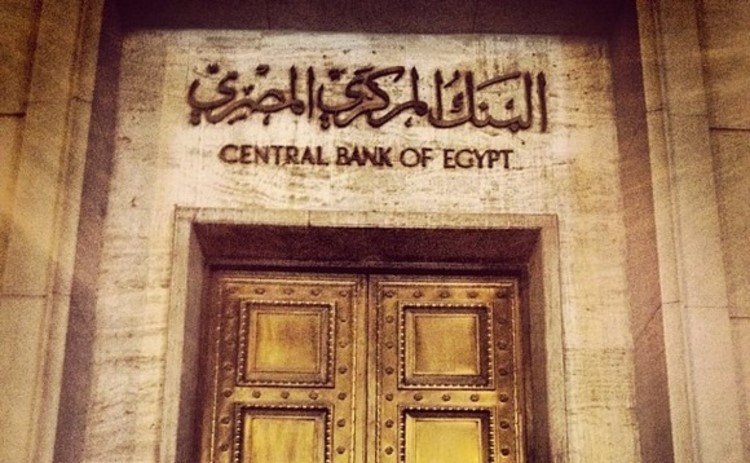

The Central Bank of Egypt (CBE), the Egyptian Banks Company (EBC) and Mastercard are collaborating to implement the new rules governing payment card coding services recently issued by CBE. Tokenization technology replaces private customer data such as the payment card account number with a token that securely completes transactions through point-of-sale, in-app or online purchases, without needing physical payment cards.

READ ALSO:

Salesforce integrates OpenAI’s GPT model with Slack for conversational AI experiences

US microchip export controls have minimal effect on China’s tech sector

CBE is leading the strategy to develop digital payments in the country, adopting rules governing coding services and establishing an infrastructure to provide safe, convenient and smooth digital payments. By doing so, they aim to attract global institutions and achieve unprecedented innovations in the digital payments market in Egypt.

The Senior Deputy Governor of CBE for Banking Operations and Payment Systems Sector, Amani Shams El Din, said that the new rules encourage innovation in the field of electronic payments and support the transformation of a society less dependent on banknotes, strengthening Egypt’s position as an innovation center for new payment services in the Middle East and Africa.