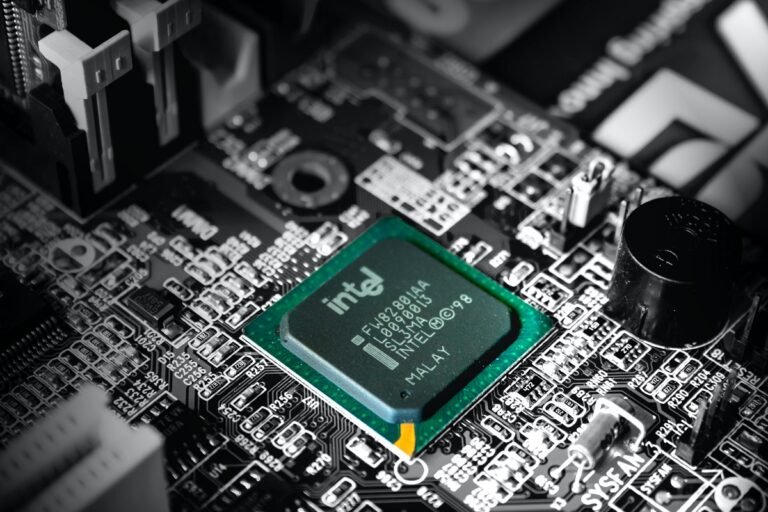

US tech giant, Intel, announced its entry into the automotive semiconductor market, unveiling plans to launch automotive versions of its latest AI-enabled chips, which will pit Intel against industry giants Qualcomm and Nvidia in the race to power the future brains of automobiles.

As part of its automotive push, Intel also revealed its acquisition of French startup Silicon Mobility, known for designing system-on-a-chip technology and software for controlling electric vehicle motors and onboard charging systems. While the purchase price remains undisclosed, Silicon Mobility is controlled by venture funds, Cipio Partners and Capital-E.

Chinese automaker Zeekr is set to be the first to integrate Intel’s AI system-on-a-chip, leveraging the technology to create an “enhanced living room experience” within vehicles. This includes AI voice assistants and video conferencing, according to Jack Weast, Intel’s automotive business chief, ahead of the CES technology show in Las Vegas.

Intel’s new automotive system-on-a-chip products will adapt the company’s recently launched AI PC technology to meet the durability and performance requirements of vehicles. Although Intel has supplied chips for infotainment systems in 50 million vehicles, it aims to challenge Nvidia and Qualcomm’s dominance in the growing market for powerful semiconductors required by automated driving technology and complex dashboard displays.

Weast spoke on Intel’s commitment to offering chips that can be utilized across automakers’ product lines, from budget-friendly to premium vehicles, setting itself apart from competitors. He criticized the scalability of Nvidia’s powerful and expensive products, signaling Intel’s focus on providing a more flexible and cost-effective solution.

China’s rapidly expanding electric vehicle market is expected to be a crucial battleground for chipmakers, with Chinese automakers racing to implement advanced infotainment systems and automated driving features. Intel’s technology is set to be utilized by Zeekr, a key player in this space.

Weast highlighted Intel’s agnostic approach, allowing automaker customers the flexibility to choose the technology for automated driving or other functions. Unlike some competitors, Intel will not mandate the use of specific advanced driving chips, giving automakers the option to incorporate their own chiplets into the Intel system at a lower cost.