Digital lending in Kenya has grown over the years. Digital lenders offer loans to Kenyans primarily via mobile apps and USSD codes.

The quick loans mostly with zero collateral have proved profitable and successful for the digital lending entities. For example, Safaricom indicated that that the government’s credit facility Hustler Fund had brought back 2 million users to M-Pesa.

Recently, the Competition Authority of Kenya (CAK) disclosed data showing the market share for the various digital lenders.

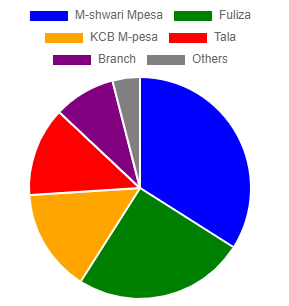

M-Shwari, an NCBA Kenya and Safaricom product accessible via Mpesa takes the lead with 34%. Fuliza, another credit facility under Safaricom comes in second with 25 percent of the market share.

In third, KCB M-Pesa has 15 per cent. Tala the first product not directly associated with Safaricom comes in fourth at 13 per cent, while Branch is at nine percent. The other digital lending companies take only four percent of the market share.

Surprisingly, the CAK data did not have Hustler fund which has been a popular credit facility among Kenyans. Reports indicate, Kenyans borrowed Kshs 30 billion within the first 6 months of Hustler fund introduction.

Currently, 32 digital lending platforms are licensed by the Central Bank of Kenya.

Digital Lending Dominated by Safaricom

The data shows that Safaricom and its partners take up the giant share of the digital credit market. Additionally, it is further proof of M-Pesa’s dominance in the fintech space.

Despite CAK’s data indicating the presence of diverse providers in the market, there is heavy preference for the M-Pesa affiliated loan facilities. These are M-Shwari, KCB-M-Pesa and Fuliza. This is despite the launch of a number of Fintech solutions tailored for different niche markets.

Furthermore, Safaricom’s dominance is seemingly bound to continue. This is after they announced their partnership with EDOMx to launch Faraja. Faraja is a Buy Now Pay Later Service that will enable more than 32 million customers buy on credit from businesses on Lipa Na M-PESA.

Customers will be able to make purchases of between Ksh. 20 and Ksh. 100,000 at zero interest fee and complete the payment within 30 days.