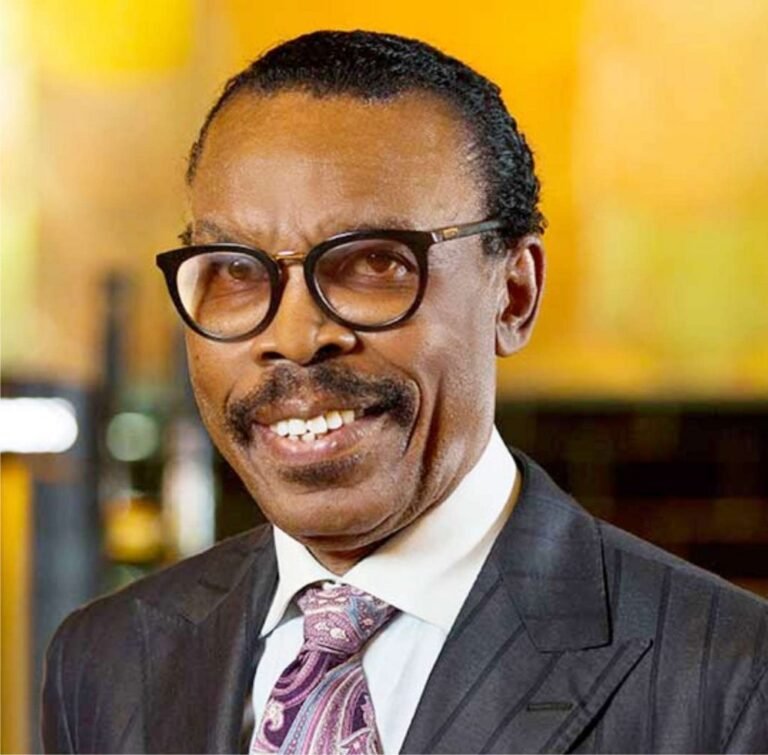

The Managing Director/Chief Executive Officer of Financial Derivatives Company Limited, Bismark Rewane has stated that fintech and mobile payments will increase during the year.

Mr Rewane made this statement while giving an outlook on the Nigerian economy in 2022 at the First Bank Nigeria Economic Outlook, themed, “A rearview look at 2021, lessons learnt-Outlook 2022.”

The bank introduced the initiative to set the tone for the year through the provision of an opportunity for participants to learn directly from economic experts to stay informed and knowledgeably empowered to make the right decisions in their socio-economic activities in 2022 which will be impacted by the micro and macro-economic activities of the country.

YOU MAY ALSO READ: Nigeria to Launch 2nd Communication Satellite this Year

Mr Bismark Rewane, the keynote speaker at the event stated that the first half of the year, H1 2022, will focus on Economics while the second half, H2 2022, will be Politics centred.

According to Rewane, “There will be a surge in Fintech and mobile payments. While the increased level of activities will be supported by 5G operations, the sector will consolidate within the year. Right now, cash in circulation is N4 trillion and the money supply is N45 trillion, so cash in circulation is only 10%. The bulk of it is electronic payments, e-commerce.”

Also, he sees Nigeria’s gross external reserves declining towards $39 billion as the CBN increases foreign exchange supply and allowed naira convergence.

Furthermore, he mentioned several outcomes that could arise as a result of two scenarios that the government could adopt during the year, the Legacy and Steady-State scenarios.

According to Mr. Rewane, for either of these scenarios, the outcomes would be “CBN will deplete reserves; MPC will raise interest rates; CRR will be lowered so banks can lend more, we’ll go back to orthodox lender of last resort; OMO will be used for liquidity management, not more than 180-day maturity and there will be a single yield curve.”

Also speaking at the event, the Group Head, Marketing & Corporate Communications of FirstBank, Ms. Folake Ani-Mumuney said,

“Being woven into fabric of the society for over 127 years means that we provide value, support and innovation-driven solutions for our stakeholders regardless of the challenges of the pandemic. Our commitment to nation-building is anchored partly on our thought leadership role designed to relentlessly drive growth and scale for all through engagements that showcase versatile subject matter experts endowed with expertise, knowledge and valuable insights.

The webinar provides a platform for cross-fertilization of ideas and opportunities to learn and grow. Nigeria is a country rich in human and natural resources and these have helped in the reforms and resilience reflected in the economy in 2021.”